EURUSD is the forex ticker that tells you how many US Dollars are needed to buy a Euro

EUR/USD nickname “fiber” is the most widely traded pair because it represents a combination of two economies in the world, and it is the most actively traded pair that consistently offering traders tight spreads and constant liquidity.

The power of eur/usd is incredible. The US dollar is the most widely traded currency and euro is the second most popular currency in the world.

The EUR/USD covers the American and European economies, so it has more than half of the total trading volume in the forex market.

EURUSD forecast is 100% free, easy to use and very accurate.

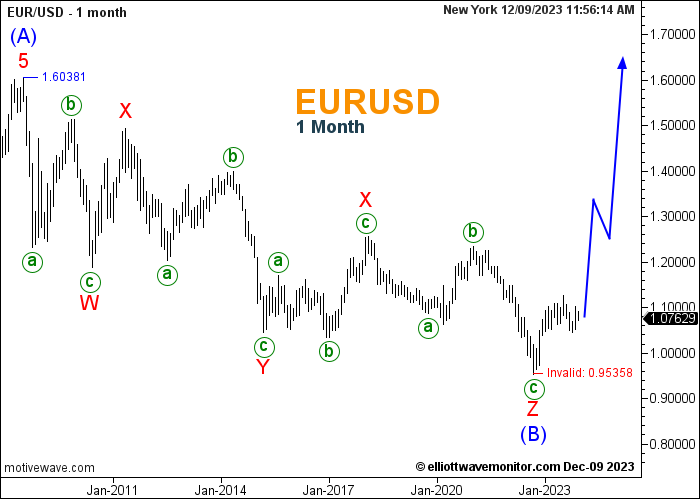

Our Forecast is based on Elliott Wave Theory and technical analysis such as price action, support and resistance levels…

Euro dollar forecast helps you to know the direction (uptrend or downtrend), expected reversal areas’ and a trust in your trade.

Our EUR/USD prediction is the best alternative to any other analysis provided by any other site because it gives the trader a complete image of the price movement and all the possible scenarios.

Check our analysis and wave forecast to know the direction of the trend and support, resistance and rebound areas.

The European central bank is the central bank of 19 European countries.

Its prime responsibility is price stability which consists of 2 main pillars of monetary policy.

The first one is the outlook for price development and risks of price stability.

The second pillar is monetary growth. Its mandate is to maintain price stability by setting key interest and controlling the supply of the Euro common currency. The bank strives to maintain the inflation level (growth in customer prices) below 2%.

The ECB Is made up of 3 decision-making bodies: the General Council, the Executive Board and the Governing Council.

The ECB holds a council meeting every Thursday and monetary policy decision meetings are held every 6 weeks.

Our EURUSD analysis helps you to identify the direction, selling and buying points in weekly, daily and hourly charts, and to know if it’s appropriate to trade at a certain time or not.

Moreover, our analysis provides many forecasting tools such as direction (upward, downward) and counting waves.

As mentioned, EURUSD analysis has many forecasting tools to identify the direction of the trend with all the available scenarios.

EURUSD pair is the most popular forex trading asset, central banks, investment banks, commercial banks, fund managers, corporates, retail traders

EURUSD forecast helps traders to extrapolate how trends will change, and know when you can trade EURUSD.

Our wave analysts prediction: An acceleration in the upward direction to reach 1.34000 based on technical analysis for EURUSD.

EURUSD exchange rate for the year 2021: best exchange rate was 1.2349, and the worst exchange rate was 1.1186

Our analysts expect the bearish trend to show down during the year and decline to 1.25000

The main fundamentals that impact the Euro dollar pair are changes in overnight interest rates by the Federal Reserve Bank and the European central bank, economic data and politics.

In US, interest rates are determined by the Federal Open Market Committee (FOMC) which consists of 7 governors of the Federal Reserve Board and 5 Federal Reserve Bank presidents.

The FOMC meets 8 times a year, while the European Central Bank (ECB) meets monthly.

Interest rates are crucial to day-traders because the higher the rate of return, the more interest is occurred and consequently the higher the profit.

So the interest rates are viewed with a wary eye as well as the news that are released from the central banks to know more about their future politics.

The Bureau of labor statistics (BLS) releases the Employment situation Summary or the job report on the first Friday of every month.

The employment data also impacts the currency market. A strong employment report can raise concerns about tighter monetary policy and forthcoming interest rate increases.

In Europe; the most important economic data comes from Germany, from the euro-wide statistics.

Key data are usually GDP, inflation (CPI), unemployment and industrial production.

Another indicator is the difference between refinancing rate and the US Fed Funds rate which is considered a good indicator for EUR/USD.

The Federal Reserve System or (Fed) is the central bank of the United States.

The Fed provides a safer, more flexible and more stable monetary and financial system.

Today the Fed’s responsibility is to achieve stability prices and maximum employment and maintain inflation below 2%.

The Fed also supervises and regulates the nation’s largest banks, maintains the stability of the financial system and contains systemic risk that may arise in financial markets, provides services to other banks, and conducts the nation’s monetary policy.