USDCHF nickname “The Swissie” is the fifth most traded pair in the forex market, representing a significant quota of daily trade.

USDCHF has huge daily trading volumes, high liquidity, and offers much tighter spreads than minor and exotic pairs.

The Swiss franc is a safe haven currency, meaning in times of global economic stress or high volatility the Swiss franc will often appreciate.

This is because of the conservative management and stability of Switzerland’s economy.

The Swiss franc displayed its safe-haven qualities during the “Great Recession” of 2007-2009 when it strengthened against all major currencies.

Because of the safe-haven factor the USDCHF currency pair has a negative correlation with gold.

That means when the price of gold rises, the USDCHF will tend to fall. USDCHF has also a negative correlation with the EURUSD pair, which means when USDCHF will tend to rise when EURUSD falls and vice versa.

USDCHF forecast is 100% free, easy to use and very accurate.

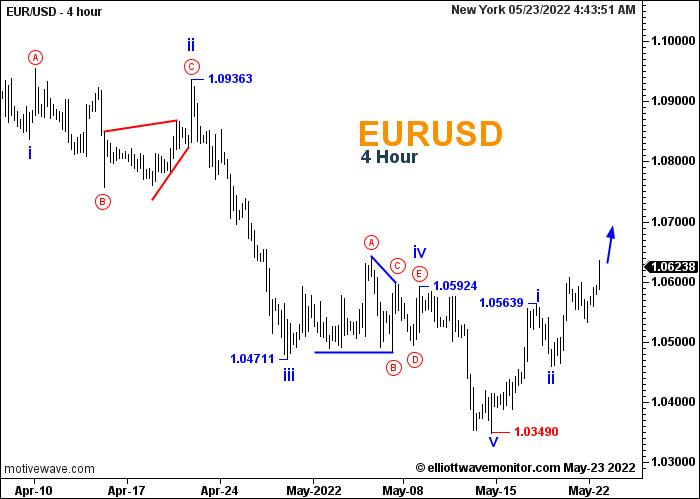

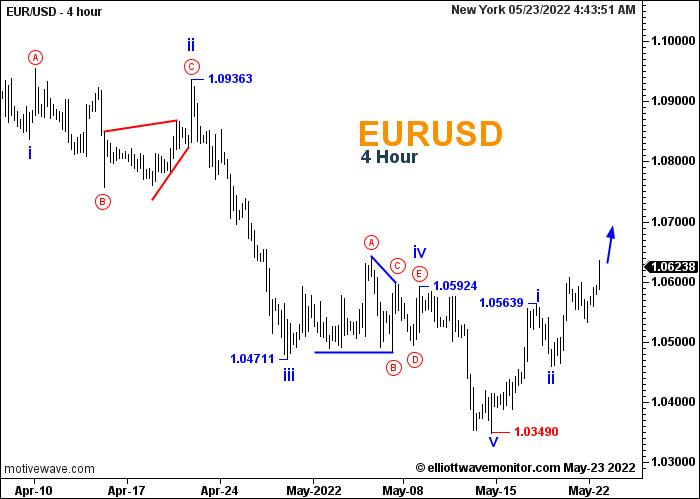

Our Forecast is based on Elliott Wave Theory and technical analysis such as price action, support and resistance levels…

This forecast helps you to know the direction (uptrend or downtrend), expected reversal areas and a trust in your trade.

Our prediction is the best alternative to any other analysis provided by any other site because it gives the trader a complete image of the price movement and all the possible scenarios.

Our USDCHF analysis helps you to identify the direction of the trend in the weekly, daily and hourly chart, selling and buying points and to know if it’s the appropriate time to trade or not.

Moreover, our analysis provides many forecasting tools such as direction (upward, downward) and counting waves.

USDCHF pair is one of the most popular forex trading asset, central banks, investment banks, commercial banks, fund managers, corporates, and retail traders.

USDCHF is affected by factors that influence the value of the U.S. dollar or the Swiss franc in relation to each other and other currencies.

The interest rate differential between the Fed and SNB will affect the currency pair.

If the SNB raises interest rates, that could lure more traders and investors to the franc and thus increase its value.

In this case, the rate would fall because it will take fewer francs to buy the US Dollar.

Switzerland has very strict banking policies in place which can affect the movement of the price of the franc.

Employment data, gross domestic product (GDP), trade balance, inflation rates, retail sales and industrial production can be scoured for information which could help indicate how the Swiss franc could move.

The Federal Statistical Office (FSO) is the national custodian of official statistical observation in Switzerland, which produces and publishes key data on areas of national importance, such as economy, population and environment.

In US, interest rates are crucial to day-traders because the higher the rate of return, the more interest is occurred and consequently the higher the profit.

So the interest rates are viewed with a wary eye as well as the news that are released from the central banks to know more about their future politics.

Check our analysis and wave forecast to know the direction of the trend, support, resistance and rebound areas.

An easy way to know whether it’s good or bad to buy USDCHF is to look at the recent history.

In our analysis, we analyze monthly, weekly, daily and hourly charts using many forecasting tools to extrapolate the direction of the trend with its corresponding scenarios.

USDCHF forecast helps traders to know the current trend, support and resistance levels. Moreover, our forecast tells you when you can trade USDCHF with all the possible scenarios.

The Swiss National Bank (SNB) is the central bank of Switzerland.

The central bank acts as an independent body, taking charge of the monetary policy and ensuring national stability.

The SNB has 13 agencies that maintain the supply of Switzerland’s national currency, the CHF (Confoederatio Helvetica’ Franc).

The SNB is responsible for implementing monetary policy, issuing and maintaining the nation’s money supply, participating in the Swiss Interbank clearing payment system, managing the nation’s currency reserves ensuring the stability of the financial system and working with federal authorities in international monetary corporation.

The Federal Reserve System or (Fed) is the central bank of the United States.

The Fed provides a safer, more flexible and more stable monetary and financial system.

Today the Fed’s responsibility is to achieve stability prices and maximum employment and maintain inflation below 2%.

The Fed also supervises and regulates the nation’s largest banks, maintains the stability of the financial system and contains systemic risk that may arise in financial markets, provides services to other banks, and conducts the nation’s monetary policy.