Where To Start Your Elliott Wave Count From?

This question is often asked by beginners who are studying Elliott Wave Theory.

Beginners think that by counting waves they can deduce the next price movement.

For instance, if the trader or the analyst counts 5 motive waves, then he will expect that the price will fall in the next movement as a corrective wave.

If that primitive method way may suit some beginner traders, but this method represents a big mistake that you must avoid.

Counting waves always come from the largest available data of the wave degree which shows important details that must be followed to know more information for the long-term and medium-term waves.

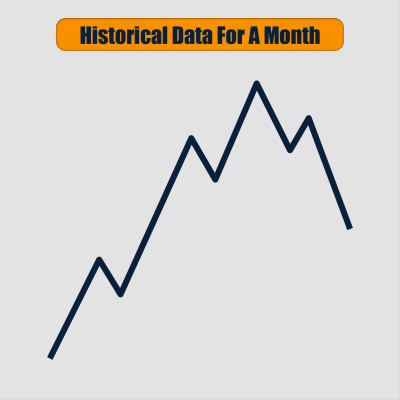

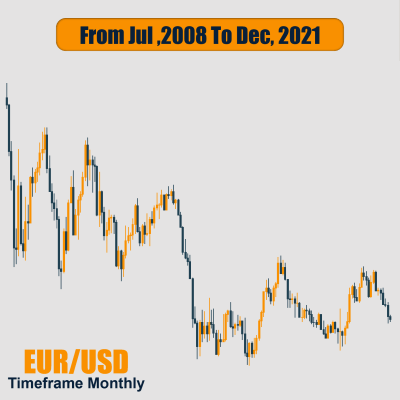

We will show an important example of the availability and scarcity of historical data.

How To Predict The Next Price Movement Using Elliott Wave?

In the above figure, we can easily determine the main pattern of Elliott wave Theory, and accordingly, we expect that if the 5 impulsive waves end, followed by 3 corrective waves and the correction ends on 50% or 61.8% Fibonacci which is the standard ratio for wave 2 correction.

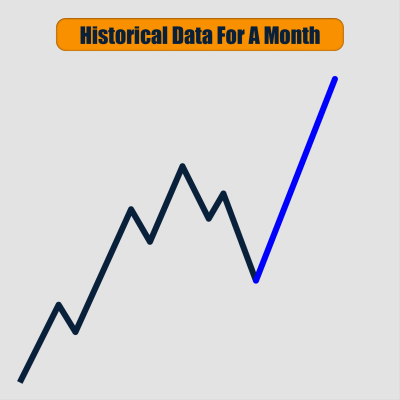

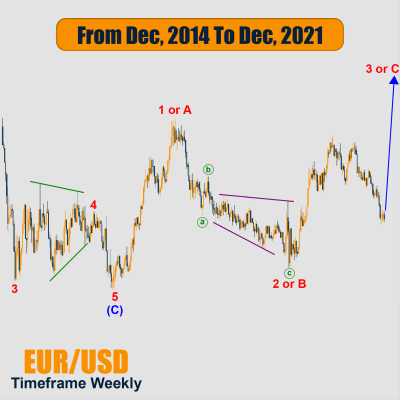

Accordingly, we will expect a strong rise in the third bullish impulsive wave as shown in the figure below.

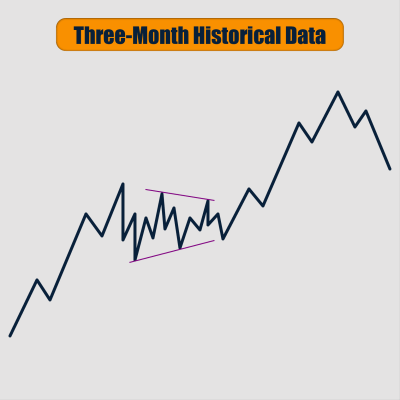

If we have more data indicating a longer historical period, as follows, will the prediction be different?

According to the difference in data, see the figure below.

Sure after having more historical data, we will see a difference in our expectations.

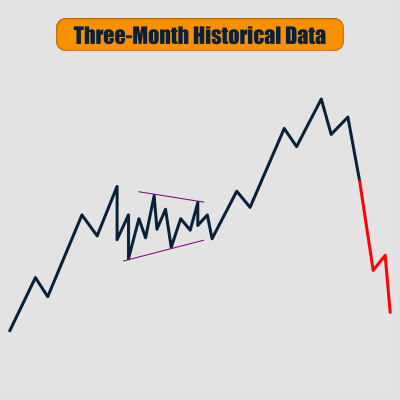

So, the correction will end in wave 3 and a return to the bearish trend again. Hence, the expected scenario will be as in the figure.

If We Have More Historical Data For Longer Periods, Will This Change Our Expectation For The Next Movement?

The answer is definitely yes, when we get more historical data, it becomes clear the correct pattern for the next movement.

The more data, the greater the accuracy in the analysis and the ability to anticipate the correct movement.

To have a more precise analysis, the wave analyst have to search for the largest possible amount of historical data, and he had to start analyzing these data according to the wave degrees.

For example, we will assume that the maximum possible data on the monthly chart is part of the grand super cycle degree and we will go down from it to the lowest degrees.

So we can analyze the monthly chart as grand super cycle followed by the weekly chart which is the super degree, then to the daily chart which is the cycle degree passing through primary degree on the 12h, then to the intermediate degree on the 8h cart, followed by the minor degree on the 4h chart and then the minute degree on the 1h chart then the minuette degree on the 5min chart and finally the sub-minuette degree on the 1min chart.

Identify Patterns With The Naked Eye In Elliott Wave

The wave analyst or the trader must understand well the patterns (impulsive and corrective waves) and train the eye to extract the pattern, which is a process that weighs with experience.

Identifying patterns by the naked eye requires experience and understanding of patterns, measurements and the conditions for each wave.

Back To Our Main Question, Where Do We Start Counting?

The answer is clear, we start counting from the monthly time-frame through the different frames until you reach the frame that you want to trade on.

You can stop at the weekly if you are an investor, or work on the daily frame or 4 hour frame and you can reach the minute frame.

Each complete wave count on a time frame is a sub-degree of a higher degree, and when the new wave is completed on a higher degree, it becomes a sub-degree of a higher degree, and so on.

So, wave analysts should deal with historical data, and start counting from the biggest time-frame to the frame that they want to trade on.

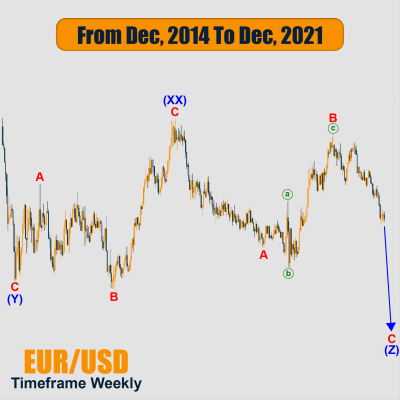

We will explain the counting of EURUSD chart from the monthly time-frame to the 4h time-frame.

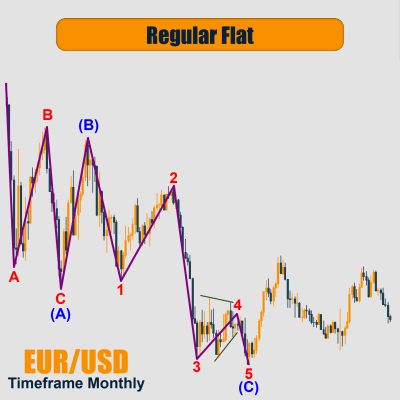

Try to identify the correct pattern. It will be easy if you understand the theory and memorize the rules and patterns.

As seen in the figure, we identified a regular flat pattern from the monthly EURUSD chart. Let us see if it’s possible to identify another pattern on this chart.

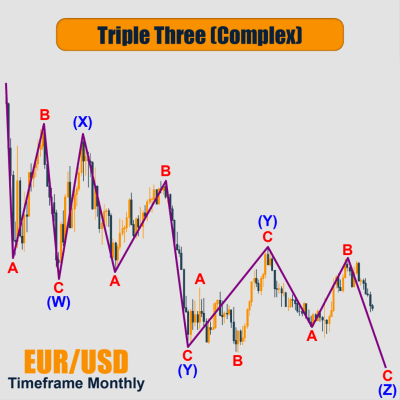

If you realized that there is another pattern on the chart which is a complex correction.

As we see, we identified 2 patterns on the chart:

- Regular flat and one of its condition that it must not break the bottom of wave C, so that bottom of wave C or the origin of wave C will be a stop loss. Eurodollar is expected to rise.

- Complex correction, and one of its condition is to break the bottom of Y, so that the top of wave XX will be stop a stop loss. Eurodollar is expected to fall.

In this case, we have to check the weekly time-frame and count the waves to choose between the 2 scenarios.

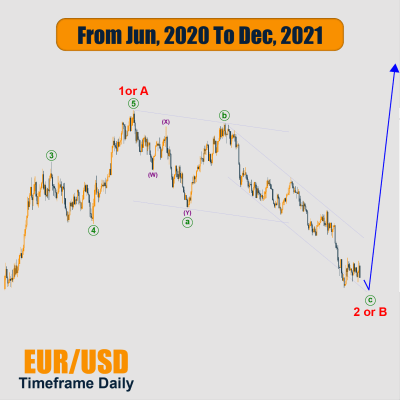

One of the conditions is not to break the bottom of wave B or 2, so that the bottom of wave B or 2 will be a stop loss. Eurodollar is expected to rise.

Another condition is to break the bottom of Y, so that the top of wave XX will become a stop loss. Eurodollar is expected to fall.

After counting the daily chart, we found that the correct pattern is the regular flat due to the last fall for EURUSD.

We found that the downward movement is a correction (W, X, Y) which is wave A of flat, followed by wave B, and we will wait till the end of the correction which is wave C of flat and the price will move upward again.

Why We Choose This Scenario?

Due to the corrective fall, if Eurodollar fell in 5 waves, then we will say that the direction will change.

But, since we weren’t able to identify a pattern that supports the fall of Eurodollar.

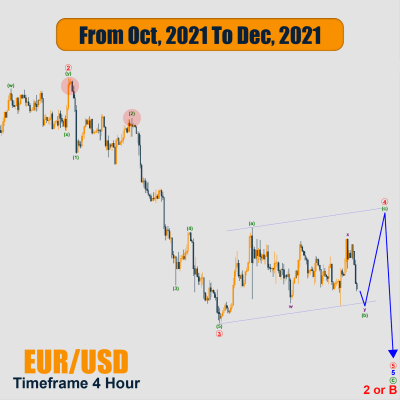

Finally, we have the 4h time-frame. In this chart, we have 5 bearish waves, the points which are highlighted in red have to be broken and exceeded, and then we can say that Eurodollar started a bullish movement.

In other words, if these points haven’t broken, Eurodollar will not move upward.

This is the feature of analysis based on Elliott wave Theory because it gives precise entering, exiting points and the areas that have to be broken to change the direction otherwise the direction will not change.