AUDUSD nickname “Aussie” is considered a commodity currency pair.

Commodity pairs involve countries that produce, import or export large quantities of raw goods.

The associated commodities are gold, crude oil and dairy products.

As prices of these items fluctuate, the AUD, CAD and NZD may post either a bullish or bearish breakout versus the U.S. dollar.

The Commodity that serves as a catalyst for exchange rate valuation of AUDUSD is gold.

Both the U.S. and Australia play a key role in the global production of gold. The United States is the World’s fifth largest exporter of gold, while Australia is the sixth-largest gold exporter.

The impact of gold pricing is very different on each currency. In respect of USD, gold has an inverse relation.

Conversely, AUD is positively associated with robust gold pricing. So when the correlation is strong, forex traders apply technical analysis to gold to determine overall market state.

In addition to being commodity driven, AUDUSD has been a vehicle by which to execute a carry trade.

AUDUSD forecast is 100% free, easy to use and very accurate.

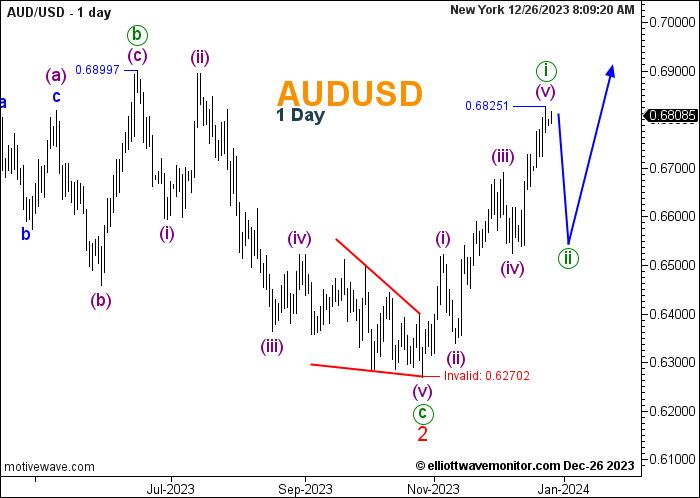

Our Forecast is based on Elliott Wave Theory and technical analysis such as price action, support and resistance levels…

This forecast helps you to know the direction (uptrend or downtrend), expected reversal areas and a trust in your trade.

Our prediction is the best alternative to any other analysis provided by any other site because it gives the trader a complete image of the price movement and all the possible scenarios.

Check our analysis and wave forecast to know the direction of the trend and support, resistance and rebound areas.

The RBA is the central bank of Australia. It sets country’s monetary policy and issues and manages the Australian Dollar by setting the interest rate in overnight money markets.

The Bank is involved in banking and registry services for federal agencies and some international central banks.

The Reserve Bank of Australia has 3 mandates: a stable currency; full employment and economic growth.

Its main role is to set the interest rate low enough to promote maximum Australian employment and economic growth, but not so low that it sparks inflation above 2% to 3% per year.

There are two boards that manage the RBA, the Reserve Bank Board, and the Payment System Board.

The Reserve Board meets 11 times per year, during these meetings, they access and discuss economic conditions and to decide on interest-rate policy.

After the meeting, the Reserve bank announces monetary policy decisions and implements those decisions through the buying and selling of short-term government debt in the open market.

The Payments System Board oversees risk in the financial system, competition in the payment services market, and promoting an efficient payment system.

An easy way to know whether it’s good or bad to buy USDCHF is to look at the recent history.

In our analysis, we analyze monthly, weekly, daily and hourly charts using many forecasting tools to extrapolate the direction of the trend with its corresponding scenarios.

AUDUSD pair is one of the most popular forex trading asset, central banks, investment banks, commercial banks, fund managers, corporates, and retail traders.

AUDUSD forecast helps traders to know the current trend, support and resistance levels. Moreover, our forecast tells you when you can trade it with all the possible scenarios.

The interest rate differential between the RBA and Fed will affect the values of these currencies when compared to each other.

For instance, if the Fed intervenes in open market activities to make the U.S. dollar weaker, the value of AUDUSD will increase.

Since Australia is the largest coal and iron exporter, the movement of its Australian dollar is heavily dependent on commodity prices.

China has a direct and significant impact on the AUDUSD since it’s the major consumer of Australian exports.

Australia Bureau of Statistics (ABS) is the Australia’s national statistical agency, it produces and publishes key economic and social data that can trigger major price movements on the AUDUSD.

It’s important for traders to watch out for monthly and quarterly data releases on the Trade Balance, the Labour marker GDP and CPI.

In the U.S. interest rates are crucial to day-traders because the higher the rate of return, the more interest is occurred and consequently the higher the profit.

So the interest rates are viewed with a wary eye as well as the news that are released from the central banks to know more about their future politics.

The Bureau of labor statistics (BLS) releases the Employment situation Summary or the job report on the first Friday of every month.

The employment data also impacts the currency market. A strong employment report can raise concerns about tighter monetary policy and forthcoming interest rate increases.

The Federal Reserve System or (Fed) is the central bank of the United States.

The Fed provides a safer, more flexible and more stable monetary and financial system.

Today the Fed’s responsibility is to achieve stability prices and maximum employment and maintain inflation below 2%.

The Fed also supervises and regulates the nation’s largest banks, maintains the stability of the financial system and contains systemic risk that may arise in financial markets, provides services to other banks, and conducts the nation’s monetary policy.

Our AUDUSD analysis helps you to identify the direction of the trend in the weekly, daily and hourly chart, selling and buying points and to know if it’s the appropriate time to trade or not.

Moreover, our analysis provides many forecasting tools such as direction (upward, downward) and counting waves.