USDCAD nickname “The loonie” is one of the most liquid actively traded pairs in the forex market.

It’s a pair which is popular amongst veteran traders and newcomers alike.

USDCAD belongs to the “majors” group as it contains the US dollar.

The major currency pairs are the most frequently traded on FX market and they have huge daily trade volumes, enjoy tighter spreads and more liquid than the minor currency pairs.

Although USDCAD has reached parity at different points in history (1:1), the U.S. dollar has traditionally been the stronger of the 2 currencies. This currency pair is quite actively traded as there are significant business ties between the two nations.

There is a high correlation between the commodity prices and the value of Canadian dollar. Since Canada’s economy is heavily reliant on oil exports, oil trading prices dictate the health of the Canadian economy and the value of CAD.

USDCAD forecast is 100% free, easy to use and very accurate.

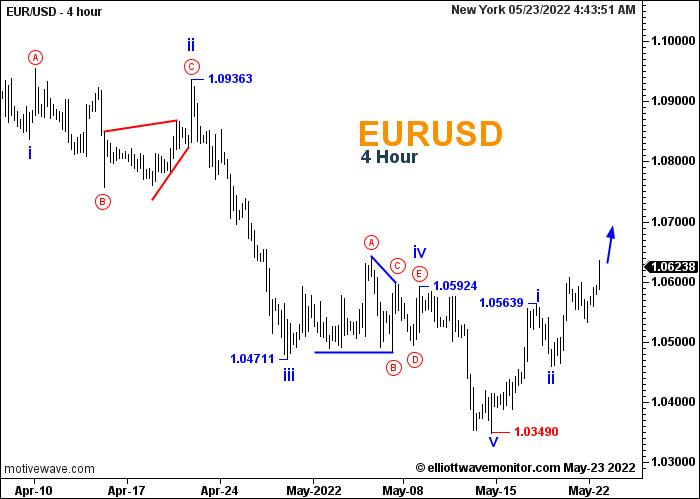

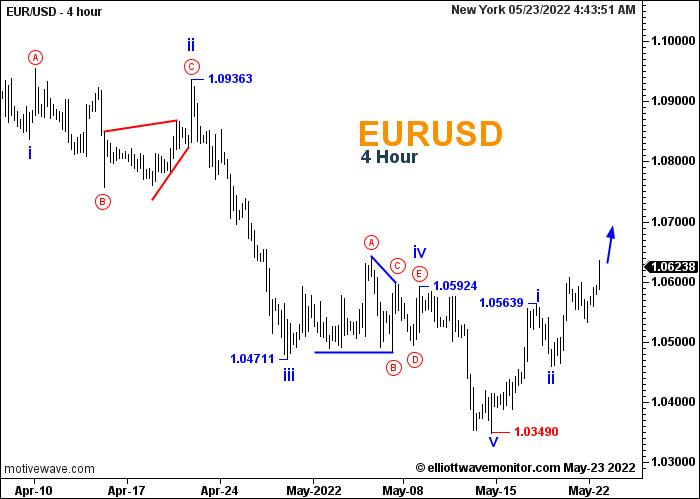

Our Forecast is based on Elliott Wave Theory and technical analysis such as price action, support and resistance levels…

This forecast helps you to know the direction (uptrend or downtrend), expected reversal areas and a trust in your trade.

Our prediction is the best alternative to any other analysis provided by any other site because it gives the trader a complete image of the price movement and all the possible scenarios.

Our USDCAD analysis helps you to identify the direction of the trend in the weekly, daily and hourly chart, selling and buying points and to know if it’s the appropriate time to trade or not.

Moreover, our analysis provides many forecasting tools such as direction (upward, downward) and counting waves.

An easy way to know whether it’s good or bad to buy USDCHF is to look at the recent history.

In our analysis, we analyze monthly, weekly, daily and hourly charts using many forecasting tools to extrapolate the direction of the trend with its corresponding scenarios.

USDCAD forecast helps traders to know the current trend, support and resistance levels. Moreover, our forecast tells you when you can trade it with all the possible scenarios.

The Federal Reserve System or (Fed) is the central bank of the United States.

The Fed provides a safer, more flexible and more stable monetary and financial system.

Today the Fed’s responsibility is to achieve stability prices and maximum employment and maintain inflation below 2%.

The Fed also supervises and regulates the nation’s largest banks, maintains the stability of the financial system and contains systemic risk that may arise in financial markets, provides services to other banks, and conducts the nation’s monetary policy.

Check the weekly and daily charts of the Pound dollar to know the direction of the arrow if it’s upward, that means USDCAD is in a bullish trend. If the direction of the arrow is downward, that means USDCAD is in a bearish trend. If the direction of the arrow is sideways that means it’s moving sideways.

Check the USDCAD 4H time-frame to see also the direction of its upward, downward or sideways.

Use your own strategy in buying, selling and entry points.

USDCAD pair is one of the most popular forex trading assets, central banks, investment banks, commercial banks, fund managers, corporates, and retail traders.

Check our analysis and wave forecast to know the direction of the trend, support, resistance and rebound areas.

The Bank of Canada (BOC) is Canada’s central bank, which is responsible for setting monetary policy, designing and issuing of Canada’s bank notes, managing funds and determining the Canadian banks’ interest rates.

It manages the Canadian government’s public debt and reserves of foreign exchange.

One of the most important roles of the BOC is setting the interest rate which is decided 8 times a year.

Canada’s monetary policy framework is designed to keep inflation low and stable.

Another important task of the BOC is creating the national currency of Canada.

In addition, BOC is the entity responsible for overseeing the pursuit of the policy in ways that it feels are best suited to Canada’s economic circumstances and inflation targets.

Trading the Loonie requires a deep understanding of the various factors that impact the values of the US and Canadian dollars, both in relation to each other and in relation to other global currencies.

The interest rate differential between the BOC and US Fed will affect the two currencies’ values in relation to each other.

Whenever the Federal Reserve intervenes in activities on the open market, in a bid to strengthen the dollar, the USDCAD will see its value increase because it will take more Canadian dollars to buy a stronger US dollar.

One of the factors that can impact the Canadian dollar is commodity prices, such as oil and zinc. Other factors that impact the CAD are employment rate, national debt levels and budget deficit as well as the quality of the relation between US and Canada.

Meanwhile, the rate of the US dollar could be affected by the interest rates as set by the Federal Reserve, the unemployment rate, the Gross Domestic Product (GDP) rates, international trade agreements, duties and tariffs, political events, consumer saving and household income rates and much more. The USDCAD currency pair has a negative correlation to the AUDUSD, GBPUSD and NZDUSD since their quote currency is the USD.