USDJPY nickname “the Yen” or the “Gopher” is the second most liquid currency pair, behind the EURUSD.

Moreover, Dollar/Yen has always been popular among forex traders, as it provides volatility throughout, and particularly during “wired” Asian hours. Despite the struggles of the Japanese economy in the 21st century, the yen remains a safe-haven.

Traders around the globe engage the USDJPY on a daily basis as a speculative vehicle.

USD/JPY has always shown a great correlation with crude oil trading price, since it’s one of the most industrialized nations in the world, and one of the largest importers of the commodity.

So the USDJPY is positively correlated with oil and negatively correlated with gold.

For instance, the pair will usually rise when oil prices are rising and fall oil prices are falling. In addition, USD/JPY tends to have a positive correlation with USDCHF because the Swiss franc is the other currency that has a safe-haven status with investors.

USDJPY forecast is 100% free, easy to use and very accurate.

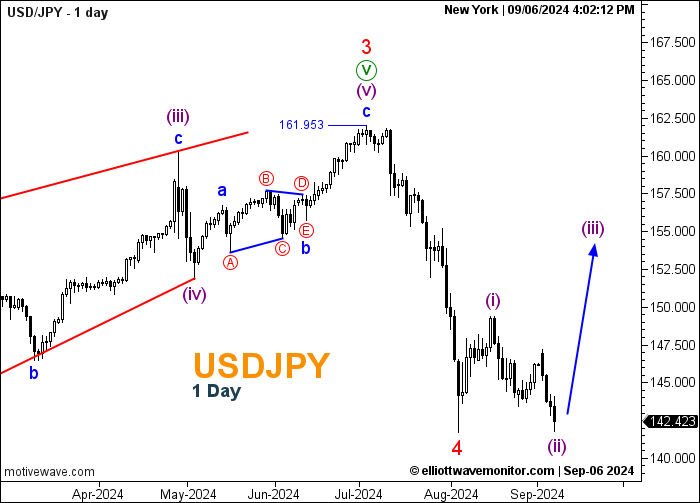

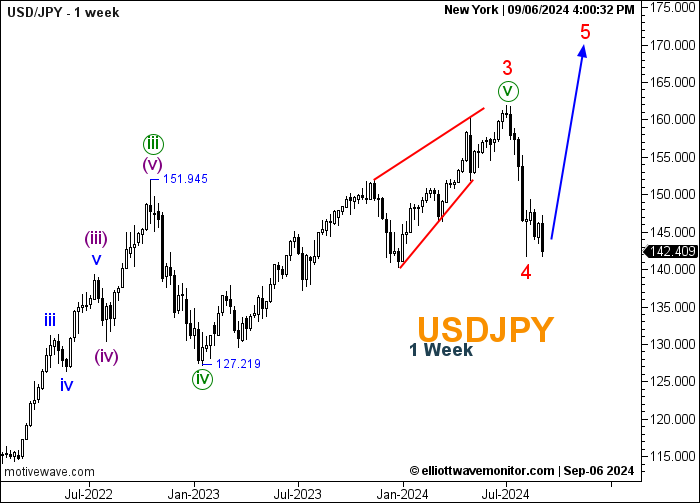

Our Forecast is based on Elliott Wave Theory and technical analysis such as price action, support and resistance levels…

This forecast helps you to know the direction (uptrend or downtrend), expected reversal areas and a trust in your trade.

Our prediction is the best alternative to any other analysis provided by any other site because it gives the trader a complete image of the price movement and all the possible scenarios.

Our USD/JPY analysis helps you to identify the direction of the trend in the weekly, daily and hourly chart, selling and buying points and to know if it’s the appropriate time to trade or not.

Moreover, our analysis provides many forecasting tools such as direction (upward, downward) and counting waves.

USDJPY forecast helps traders to know the current trend, support and resistance levels. Moreover, our forecast tells you when you can trade it with all the possible scenarios.

The USD/JPY is affected by factors that influence the value of the U.S. dollar and the Japanese yen, both in relation to each other and to other currencies.

The major body influencing the USD/JPY is the Bank of Japan (BoJ), which releases interest rates monthly accompanying them with rate statements that will give traders and investors an idea of future policy direction.

The Fed will also impact the USD/JPY pair, with major monetary policy decisions capable of forming long lasting trends on the pair.

In addition, Japan’s Statistics Bureau also releases important data periodically that can have significant impact on the pair.

Data such as Trade Balance, GDP and Current Account almost always spur much volatility on the USDJPY.

The Japan Meteorological Agency is also an important body that can influence USD/JPY prices, and since Japan is an earthquake prone nation, severe earthquake warnings can pile pressure on the Japanese yen and consequently impact Dollar/Yen rate.

The economic relationship between the U.S. and Japan is based on each country’s trade balance.

Both countries are financial superpowers, ranking among global elite in many categories including GDD, imports and exports.

Japan depends on the importation of raw materials and energy from the U.S. in order to fuel its industrial sectors. The U.S. imports manufactured goods from Japan in large equities.

Dollar/Yen pair is one of the most popular forex trading asset, central banks, investment banks, commercial banks, fund managers, corporates, and retail traders.

Check our analysis and wave forecast to know the direction of the trend, support, resistance and rebound areas.

An easy way to know whether it’s good or bad to buy USD/JPY is to look at the recent history.

In our analysis, we analyze monthly, weekly, daily and hourly charts using many forecasting tools to extrapolate the direction of the trend with its corresponding scenarios.

The Federal Reserve System or (Fed) is the central bank of the United States.

The Fed provides a safer, more flexible and more stable monetary and financial system.

Today the Fed’s responsibility is to achieve stability prices and maximum employment and maintain inflation below 2%.

The Fed also supervises and regulates the nation’s largest banks, maintains the stability of the financial system and contains systemic risk that may arise in financial markets, provides services to other banks, and conducts the nation’s monetary policy.

The Bank of Japan (BoJ) is the Japanese central bank, which is responsible for issuing and handling currency and treasury securities, implementing monetary policy, maintaining the stability of the Japanese financial system, and providing settling and clearing services.

BoJ also complies and aggregates economic data, produces economic research and analysis, and makes the information available to the public.

The bank’s Policy Board is the Bank’s decisions-making body, which sets currency and monetary controls, and oversees the duties of the Bank’s officers, excluding auditors and counselors.

Monetary policy is decided by the Policy Board at Monetary Policy Meetings (MPMs).

The Bank of Japan immediately releases its decisions on monetary policy after each MPM.

The bank holds regular press conferences by the chair of the Policy Board to explain monetary policy decisions.

MPMs are held 8 times a year for 2 days. The bank uses in-depth research and analysis on economic and financial conditions when deciding monetary policy.

The BoJ also releases its transcripts 10 years later to provide transparency regarding Policy Board decisions.