GBPUSD is the forex ticker that tells you how many US Dollars are needed to purchase one British Pound.

GBPUSD nickname “The Cable ” is among the top 5 most-widely traded currency pairs in the world and it’s one of the most liquid currency pairs in FX market. The narrow bid-ask spreads, volume and volatility all contribute to why GBPUSD pair is so popular to trade.

You can trade forex pairs at any time, but there are prime times to trade the GBPUSD when the currency is more volatile. The GBPUSD is generally busy between 06:00 GMT and 16:00 GMT

GBPUSD forecast is 100% free, easy to use and very accurate.

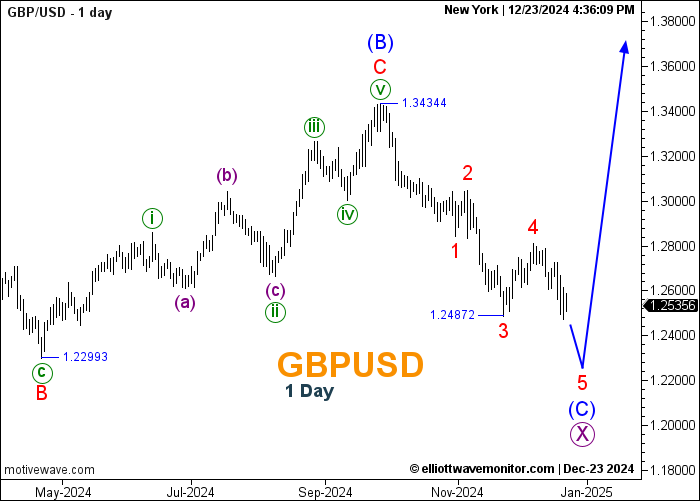

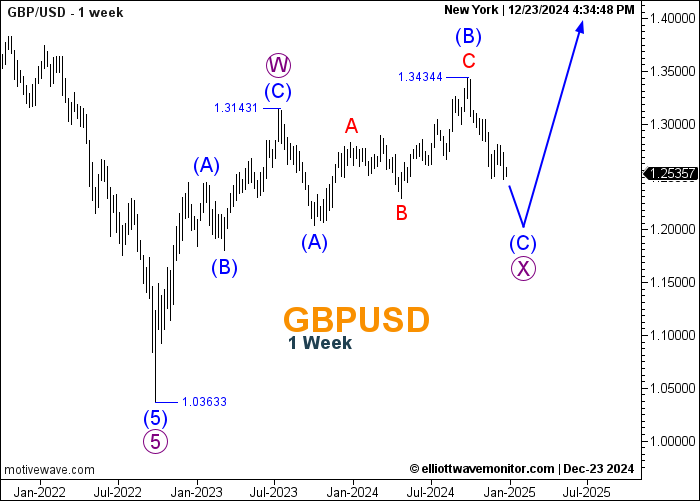

Our Forecast is based on Elliott Wave Theory and technical analysis such as price action, support and resistance levels…

Pound Dollar forecast helps you to know the direction (uptrend or downtrend), expected reversal areas’ and a trust in your trade.

Our GBPUSD prediction is the best alternative to any other analysis provided by any other site because it gives the trader a complete image of the price movement and all the possible scenarios.

Our GBPUSD analysis helps you to identify the direction of the trend in the weekly, daily and hourly chart, selling and buying points and to know if it’s the appropriate time to trade or not.

Moreover, our analysis provides many forecasting tools such as direction (upward, downward) and counting waves.

An easy way to know whether it’s good or bad to buy GBPUSD is to look at the recent history.

In our analysis, we analyze monthly, weekly, daily and hourly charts using many forecasting tools to extrapolate the direction of the trend with its corresponding scenarios.

An easy way to know whether it’s good or bad to buy GBPUSD is to look at the recent history.

In our analysis, we analyze monthly, weekly, daily and hourly charts using many forecasting tools to extrapolate the direction of the trend with its corresponding scenarios.

The interest rate differential between the Bank of England (BoE) and the Federal Reserve will affect the value of these currencies when compared to each other.

Monetary policy is one of the most important factors that influence the GBPUSD. Communications from both central banks can be one of the biggest determinants of the GBPUSD pair value.

Prices and inflation play a crucial role in the value of the GBP. To gauge levels of inflation in the U.K., traders will typically follow the Consumer Price Index (CPI), which calculates the changes in prices of goods and services purchased in a given period. Confidence and sentiment reports for the U.K. are important, many traders will follow the Gfk Consumer Confidence and the Nationwide consumer Confidence Index (NCCI) reports to track sentiment in U.K.

Another key factor that can impact the currency values is the level of economic activity in U.K. The Primary measure of economic activity is the gross domestic product (GDP).

Traders should be aware of 3 different GDP reports: Preliminary GDP, Revised GDP and the final GDP. Preliminary GDP has the biggest impact because it gives traders a first look into the economic health of the U.K.

GBPUSD pair is one of the most popular forex trading asset, central banks, investment banks, commercial banks, fund managers, corporates, and retail traders.

Our wave analysts prediction: An acceleration in the upward direction to reach 1.50000 based on technical analysis for GBPUSD.

GBPUSD exchange rate for the year 2021: best exchange rate was 1.42500, and the worst exchange rate was 1.31605.

Our analysts expect the bearish trend to show down during the year and decline to 1.36585.

Check our analysis and wave forecast to know the direction of the trend, support, resistance and rebound areas.

The Federal Reserve System or (Fed) is the central bank of the United States.

The Fed provides a safer, more flexible and more stable monetary and financial system.

Today the Fed’s responsibility is to achieve stability prices and maximum employment and maintain inflation below 2%.

The Fed also supervises and regulates the nation’s largest banks, maintains the stability of the financial system and contains systemic risk that may arise in financial markets, provides services to other banks, and conducts the nation’s monetary policy.

The Bank of England (BoE) is the central bank of the United Kingdom.

It has a wide range of responsibilities similar to those of most central banks around the world.

The BoE issues currency and, most importantly, oversees monetary policy.

The BoE is equivalent to the Federal Reserve System in the U.S. It has been responsible for setting the UK’s official interest rate since 1997.

The Monetary Policy Committee (MPC) is led by the Governor of BoE, which meets eight times a year to consider the need to change interest rate policy to achieve the government’s inflation target.